Craft online insurance storefronts easily.

We’re in the business of modernizing insurance. With our expertise on UX, hardware, infrastructure, and the insurance industry, you’ll be sure to find the optimal solution for any insurance need.

With competitive prices and an extensive preset library, we are the go-to source for advanced insurance solutions in North America.

We’re making it easier for you to integrate new solutions without disrupting existing models. Mission #1 is zero downtime.

Get digital transformation by focusing on a specific problem, and then assign InsureCert to do the work.

Build API layers that can seamlessly integrate with any retailer or system. Reach clients where they are.

InsureCert is a very efficient and well run system. The support provided by the staff is second to no one -very quick response and always friendly and very helpful.

Georgette Corbet ONA Insurance Brokers

InsureCert’s “no-code” platform accelerates app development, reducing the time required to configure applications and get programs online. Design and distribute insurance programs to brokers, agents, or direct to consumers on any device or website. InsureCert is scalable, inherently secure, and built for speed. We have your solution when it comes to automation.

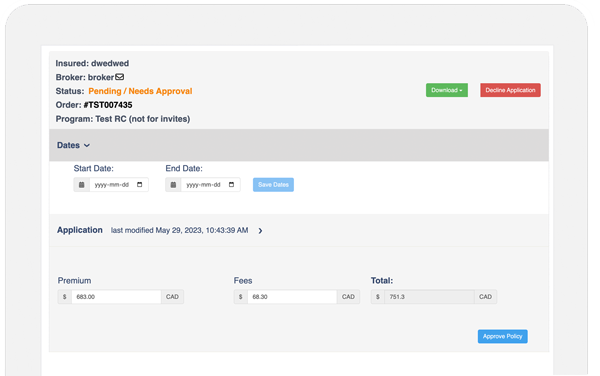

Level up your teamwork and let underwriters connect directly to marketing agents, allowing them access to carrier rates and policy wordings. Automate quotes or manually apply overrides. Review and validate applications, reduce clerical errors, and minimize keying in data. With InsureCert, everything is in oneplace, making it possible to fully automate day-to-day submissions from your brokers and agents.

InsureCert is a DNS Web Service allowing highly configurable all-in-one quote, bind and issue workflows that lets you sell insurance using recurring credit cards (memberships), monthly payments or agency bill invoicing. We can run via AWS anywhere you require the data to be stored. The choice of how your deliver your invoices and policies is up to you.

InsureCert's powerful rating engine can automatically price calculate risk cutting processing costs by 80% over traditional underwriting workflows. Experience modern insurance software that runs on any domain. We are the premiere cloud insurance rating engine platform. Build embedded insurance apps and distribute capacity anywhere.

Get up-to-the-minute reports delivered straight to your inbox on a set schedule. With our extensible report module, you can build complex calculations, loss ratios, and more. Say goodbye to frustrating, repetitive report building. Have it your way, every day.

InsureCert is a codeless insurance platform. What does that mean? It means you can build and deploy fully functional insurance websites without knowing a single line of code. Use our simple, easy to understand program builder to build forms, apply rules and rate answers using classes and cvc file uploads giving you more power to update prices and dynamically change policy documents based on user selected options. When you're ready to publish, add 'A' records to your DNS provider for true white-label branding.

Yes! By far. InsureCert helps shoppers get insurance done faster online. We work with carriers and MGAs to build instant quote solutions making it easier than ever. You can customize InsureCert to be accessible through passwords, as a broker portal, or let anyone checkout in just a few steps.

No. We work independently with multiple insurers without bias or favor toward any of them. It’s important to us that we help you find the right insurance policy for your needs — not which company you buy it from.

Depending on the program, we get paid a SAAS fee or a share of the service fee, or, in some circumstances, insureCert can be the broker of record getting paid a commission in BC. on select programs. If you are a consumer of insurance, it's important to know that your broker's job is to make sure you get the right coverage for your needs. We don't give preference to any one insurance company because our compensation on any particular purchase may vary depending upon the type of product, insurer(s), including the volume in business with them at hand. Always seek the advice of a trusted insurance broker who's duty of care is to you, and not anyone else.

Many of our clients create online quotes where agents can get real-time quotes. While InsureCert does not directly invite or allow access to online portal programs, we are certainly willing to make introductions if you reach out to us. If you live or work in BC, Canada, our brokerage division will gladly help you find the right coverage. InsureCert Brokerage